Instructions to payout final wages for terminations and retirements.

UC’s Office of General Counsel has determined that the university is not subject to California Labor Code, Sections 200-243. This web page specifically addresses when to payout final wages for voluntary and involuntary terminations, and retirements.

In regard to represented employees, we must comply with any language specified in the employee’s collective bargaining agreement. Once the E-078 is submitted UCPC will make the determination when the employee should receive their final pay based on the language in the employee's collective bargaining agreement.

In most instances, final pay will be dispersed per the employee's normal method of pay (i.e. direct deposit, paper check).

Department Responsibilities

- Process the correct Termination Template to separate the employee in a timely manner to ensure employees receive final pay on time

- Submit a Final Pay Request as part of the termination for the following:

- Represented employees

- Involuntarily terminated employees

- Employees with accruals to be paid out

- Employees who are unable to report all hours in time and attendance system

- Ensure hours for final pay period in Time & Attendance match Final Pay Request but hours are flagged to not submit to I-181

- Accurate hours in Time & Attendance are required for record keeping

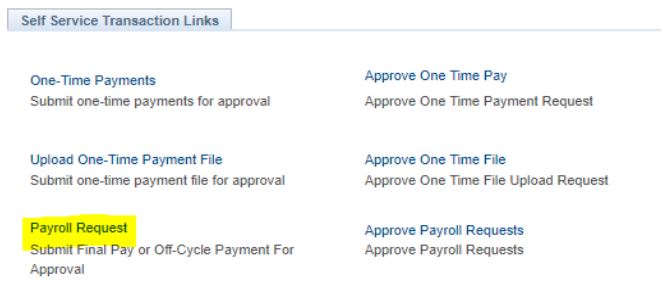

Process Steps

- Initiate Voluntary Termination Template Transaction

- Initiate Involuntary Template Termination Template

- Initiate Retirement Template Transaction

- Represented employees

- Involuntarily terminated employees

- Employees with accruals to be paid out

- Employees who are unable to report all hours in time and attendance system

- Employee is represented (final pay will automatically be flagged as off-cycle)

- Employee is being involuntarily termed (final pay will automatically be flagged as off-cycle)

- Non-represented employee has accruals to pay out (final pay will be on-cycle)

- Non-represented employee is exempt and used hours (sick/vacation/PTO) that will not be picked up by the monthly pay compute deadline (final pay will be on-cycle)

- Any accrual usage should be reported and will be picked up per the normal process

- Make sure to check the Payout Accruals box on the Leave Tab to ensure payout of accruals

- Earnings Tab

- Include REG hours, day-by-day, for all days worked during the final pay period(s)

- Enter one line per day

- Leave Tab

- Include accruals used (sick, vacation, PTO, Comp Time) used during the final pay period(s). If no hours were used, please state in the comments that employee did not use any accruals. This confirmation helps UCPC to ensure that no overpayment will occur

7. If employee has multiple job records and is terminating from all records, a final pay request must be completed for each employee record that has associated compensation. Coordination between departments will be required.

- If termination is due to death or retirement, then all records will be automatically termed

Other Considerations

- Submit transaction to termination employee PRIOR to submitting Final Pay Request

- In the cases of involuntary terminations, partner with the appropriate HR resources to ensure compliance with policy

- In extenuating circumstances and a physical check is required, reach out to Payroll for guidance prior to submitting E-078 transaction.

- Confirm that employee is not taking another UC job as this may be a transfer not a termination

- Incorrect action reason code may impact the employee’s benefits

- If the employee is on a Short Work Break or Leave of Absence, ensure that the Last Date Worked is accurate. The system defaults this date to the day prior to the termination effective date

- Use Job Data Update form for corrections

- If corrections to an action reason or effective date of termination is needed, locations must submit the Job Data Update form via Case to the UCPath Center

- Review the Person Org Summary page before submitting a termination to ensure that employee record has not already been terminated