Overpayment Request

Instructions on processing an overpayment request and coordinating repayment options for the impacted employee.

Pre-Process

The systemwide controllers group recently decided to set a materiality threshold of $100 for overpayments. Due to the administrative costs associated with the processing of overpayments any gross overpayment of $100 or less per paycheck will not be pursued or corrected in the payroll system.

Before processing an E-078 for Overpayment, determine if overpayment can be repaid by reducing pay or hours. The following criteria must be met:

- Transaction that caused the overpayment is for the current calendar year

- Employee has provided written authorization to reduce pay or hours

- Transaction is under 50% of employee’s current pay to ensure that employee deductions will not be impacted

If yes, then submit negative hours via I-181 or flat dollar amount via I-618 which will reduce the employee’s future checks

Process Steps to Submit E-078 Overpayment

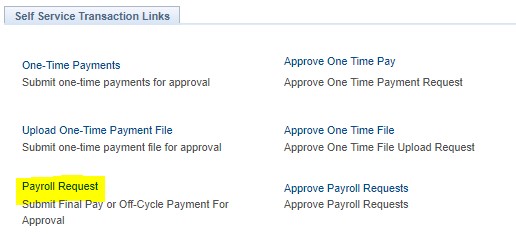

- Navigate to the Self-Service Transaction page

Navigation: PeopleSoft Menu>UC Customizations >UC Extensions>Self Service Transactions Links

- From the Self-Service Transaction Links page, click the Payroll Request link.

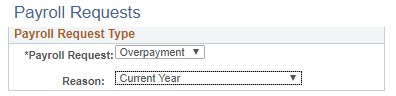

- On the next screen, there will be a drop-down field. From this field, select Overpayment

- Refer to the Submit Overpayment Pay Request UPK for step-by-step instructions to perform this transaction

Hours must be prorated based on the monthly working hours for a particular month. There are four possible variations:

100 percent of Hours Worked

- 184 Hour Month

- 176 Hour Month

- 168 Hour Month

- 160 Hour Month

Automatic hour generation should be prorated based on FTE. That is, the FTE should be multiplied against the monthly working hours each month to derive the total hours worked. Given the variations above, the hours worked for a job of FTE .60 would be as follows:

- 184 Hour Month: 110.40 hours

- 176 Hour Month: 105.60 hours

- 168 Hour Month: 100.80 hours

- 160 Hour Month: 96.00 hours

- Specific details must be included in the comments to provide context to the UCPath Center the reason for the overpayment. Submit for AWE routing

- Submit AggieService case or send email to Payroll specialist with subject line "Overpayment" providing transaction ID and employee's name in the body of the message.

- When the UCPath Center receives the Overpayment Request transaction, they will generate an overpayment packet that will be relayed via UCPath Case to Central Payroll to validate amount. Payroll will then send the packet back to the Initiator that submitted the Overpayment Request.

- Upon receipt of the AggieService or email case from Central Payroll, the Initiator should meet with the employee and walk through the process and return the required documents back to Central Payroll who will then submit it to the UCPath Center within the requested timeline.