Manual Payroll Interface Files - I-181 & I-618

Guidance on processing manual UCPath Interface files impacting Payroll, including roles and responsibilities for Department/Service Channels, Payroll and UCPath Center.

Department/Service Channel

- Identifies the need for processing a manual I-181 or I-618

Payroll

- Validates Excel Template for I-181 & I-618 to ensure formatting is valid for processing

UCPath Center

- Validates Interface File and processes successful rows.

- Rejects errors onto an E-010 report for corrections

Process Steps to populate I-181 or I-618

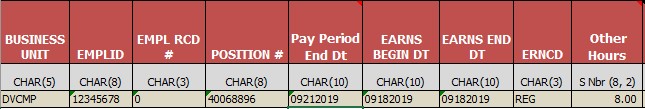

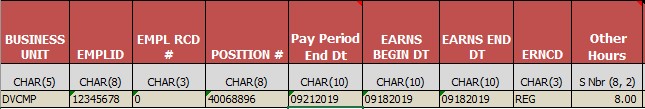

- Open template for I-181 to process hours only or I-618 to process amounts only

- Navigate to Job Data in order to obtain the following information needed to process the file:

- EMPL ID

- Employee Record

- Position Number

Navigation: PeopleSoft Menu > Workforce Administration > Job Information > Job Data

- Key in the Current Pay Cycle Period End Date in the following format: MMDDYYYY

- To ensure your date is in the proper format, use “Text” from the formatting dropdown

- The Pay Period End Date MUST be the current cycle, you should not prior or future period end dates.

- Key in the Earnings Begin and Earnings End Dates

Note: The I-181 must be reported by day, whereas the I-618 can be reported by pay period.

- Key the Earnings Code

Note: Some Earnings Codes are now split, one for hourly employees and one for salaried employees.

- Key in the Hours for I-181 and Amount for I-618

- Save Excel Template using the Interface and Pay Period End Date in your file name

- EX: “I-181 PPE 09212019”

Process Steps to Send I-181 or I-618 for Upload

Each Service Channel has designated a select group of individuals who can use the following link for getting their manual file to Central Payroll: https://securesend.ucdavis.edu/filedrop/ucpath

- After saving your Excel Template, fill out the form indicating:

- The type of Interface file

- The submitter’s name

- Which Service Channel the file is from

- A Brief Message

- Once submitted, Central Payroll will review all files received and consolidate into 1 manual file for processing to UCPC

- UCPC will process successful rows. An E-010 will generate for rows with errors.

- If an E-010 generates, Central Payroll will take a high level look and distribute errors out to the responsible Service Channel for review and resubmission on a correction file.

- Submission for corrections files will follow the same process as the initial manual file.

Sample I-181

Sample I-618