Guidelines to assist DTAs in the calculation of holiday hours for positive employees in TRS and non-TRS employees.

Is the employee full-time on the holiday?

A full-time employee is one whose fixed appointment percentage is 100%. A part-time employee is one whose variable appointment is at least 50% but less than 100%, even if the employee occasionally works up to 100%. The percentage used to determine whether the employee is full time or part time is based on aggregated percentage of all active assignments (appointments) on the holiday. Additional consideration should be given to the collective bargaining contract for the specific employee.

If yes:

- Generate eight hours of holiday pay as long as employee's job assignment is active on the holiday.

- This ensures full time employee will always receive 8 hours of holiday pay even if employee did not work 100% in the previous or current pay cycles.

- If multiple assignments are active on the date of the holiday, distribute hours according to FTE percentage and round the result to the nearest quarter hour. Allocate the leftover amount to the last job to ensure the total sum is correct.

If no:

- Calculate holiday based on pay status hours in the quadri-weekly cycle.

- As specified in the UCPath Holiday Standardization document, quadri-weekly cycle used for calculating holiday pay is to be standardized as the two bi-weekly (BW) pay cycles immediately preceding the BW pay period in which the holiday occurs.

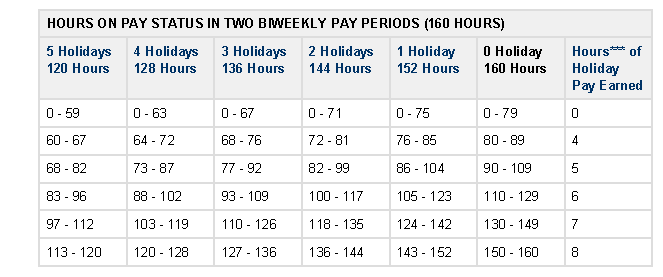

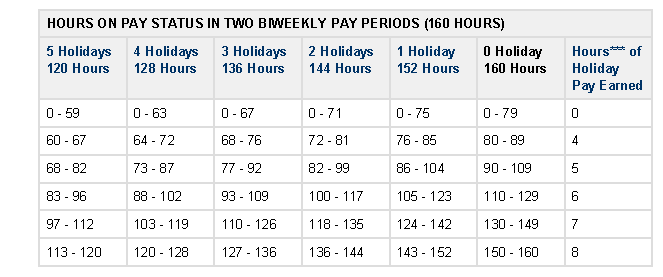

- The following table is used to derive the number of earned holiday hours per holiday based on the pay status hours in the quadri-weekly cycle.

- Note that the Number of Holidays in the table heading is for the two preceding cycles, therefore calculation based on 0 Holiday is needed when the two preceding cycles contain no holiday.

- Holiday hours will be rounded up to accrue in whole hour increments per UCPath Holiday Standardization.

- The definition of "pay status hours" is REG hours from time worked and paid leave hours. It does not include: overtime, leave without pay and earned holiday hours. In order to determine the pay status hours, full scale calculation will need to be triggered for the two preceding cycles (excluding holiday calculation).

- Hours of Holiday Pay Earned is per holiday.

- For employees on multiple assignments, the distribution of earned holiday hours across multiple assignments will be based on pay status hours reported on each assignment proportionally in the quadri-weekly cycles. The result is rounded to the nearest quarter hour.

- Limitations: if the first bi-weekly pay period a department begins to participate in TRS has a holiday, there will not be any hours in TRS from the two prior cycles to run holiday calculation correctly for any part time employees (both limited and career). In this case, holiday hours need to be calculated and handled outside of TRS unless an appropriate logic could be identified for TRS to recognize the scenario and default to appointment percentage based calculation.

Examples & Calculation Comparison

Example 1: Calculation for pay period 8/31-9/13, which contains Labor Day (9/1)

- Employee is 100% FTE. Employee's assignment starts on 9/3.

- Calculation is not triggered since employee's assignment is not active on the holiday.

- TRS is currently calculating Earned Holiday for employees who start after the holiday and are 100% (this is a known bug)

Example 2: Calculation for pay period 8/31 - 9/13, which contains Labor Day (9/1). Employee is not a new hire

- Employee is on Assignment A at 20% FTE, and Assignment B at 80% FTE.

- Combined FTE = 100% so TRS calculates 8 hours of holiday pay, and distributes to assignments based on FTE:

| TRS Employee |

Non-TRS or Manual Calculation |

| Assignment A: 8 hrs x 0.2 = 1.6 (rounded to 1.5) |

Assignment A: 8 hrs x 0.2 = 1.6 (rounded to 1.5) |

| Assignment B: 8 hrs - 1.5 hrs = 6.5 hrs (Assign the leftover holiday pay amount to Assignment B to prevent any deviation due to the rounding process |

Assignment B: 8 hrs x 0.8 = 6.4 hrs (rounded to 6.5) |

| Assignment A pays 1.5 hrs and Assigment B pays 6.5 hrs |

Assignment A pays 1.5 hrs and Assigment B pays 6.5 hrs |

Example 3: Employee is 80% variable. Employee is not a new hire. Employee has reported a total of 86 pay status hours in the previous 2 pay periods with no holidays

| TRS Employee |

Non-TRS or Manual Calculation |

| Use chart to locate eligibility for 86 hrs worked in cycle with no holidays |

Hours worked (86) divided by total hours in cycle (160) = .5375 x 8 hrs = 4.3 hrs (rounded to 4.25) |

| Employee is eligible for 4 hrs of holiday pay |

Employee is eligible for 4.25 hrs of holiday pay |

Example 4: Employee is on Assignment A at 40% and Assignment B at 40%. Employee is not a new hire

- In period 1 of cycle: 32 hours on Assignment A; 32 hours on Assignment B.

- In period 2 of cycle: 44 hours on Assignment A; 32 hours on Assignment B.

- Employee reported a total of 140 hours in the previous 2 pay periods with no holidays - TRS generates 7 hours of holiday pay.

| TRS Employee |

Non-TRS or Manual Calculation |

| Assignment A: 7 hrs x (76 / 140) = 3.8 (rounded to 3.75 hrs holiday) |

Assignment A: Total hours (76) divided by total in cycle (160) = .475 x 8 hrs = 3.8 hrs (rounded to 3.75 hrs) |

| Assignment B: 7 hrs - 3.75 hrs = 3.25 hrs |

Assignment b: Total hours (64) divided by total in cycle (160) = .40 x 8 hrs = 3.2 hrs (rounded to 3.25 hrs) |

| Total holiday earned is 7 hrs (3.75 hrs + 3.25 hrs = 7 hrs) |

Total holiday earned is 7 hrs (3.75 hrs + 3.25 hrs = 7 hrs) |

Example 5: Calculation for pay period 11/16 - 11/29, which contains Thanksgiving Holidays (11/27, 11/28)

- On 11/27: Employee is on Assignment A at 85% fixed and on Assignment B at 15% fixed (last day on assignment A and B is 11/27)

- On 11/28: Employee begins new Assignment C at 100% fixed time.

- For 11/27: Employee's aggregated FTE percentage is 100%. TRS generates 8 hours of holiday pay

- For 11/28: TRS generates 8 hours of holiday pay for Assignment C.

| TRS Employee |

Non-TRS or Manual Calculation |

| Assignment A: 8 hrs x 0.85 = 6.8 hrs (rounded to 6.75 hrs) |

Assignment A: 8 hrs x 0.85 = 6.8 (rounded to 6.75) |

| Assignment B: 8 hrs - 6.75 hrs = 1.25 hrs (Assign the leftover holiday pay amount to Assignment B to prevent any deviation due to the rounding process |

Assignment B: 8 hrs x 0.15 = 1.2 hrs (rounded to 1.25) |

| Assignment A pays 6.75 hrs and Assigment B pays 1.25 hrs for 11/27 |

Assignment A pays 6.75 hrs and Assigment B pays 1.25 hrs for 11/27 |

| Assignment C pays 8 hrs for 11/28 |

Assignment C pays 8 hrs for 11/28 |

Example 6: Employee is on Assignment A at 15% and Assignment B at 70% variable. Employee is not a new hire

- In period 1 of cycle: 6 hours on Assignment A; 56 hours on Assignment B.

- In period 2 of cycle: 10 hours on Assignment A; 59 hours on Assignment B.

- There is 1 holiday in the quadri-weekly cycle

- Employee reported a total of 131 pay status hours – TRS generates 7 holiday pay per holiday.

- Employee's aggregated FTE percentage is 85%. TRS distributes holiday pay based on the pay status hours reported in the quadri-weekly cycle

| TRS Employee |

Non-TRS or Manual Calculation |

| Assignment A: 7 hrs x (16 / 131) = .855 (rounded to .75 hrs holiday) |

Assignment A: Total hours (16) divided by total in cycle (152) = .105 x 8 hrs = .84 hrs (rounded to .75 hrs) |

| Assignment B: 7 hrs - .75 hrs = 6.25 hrs (Assign the leftover holiday pay amount to Assignment B to prevent any deviation due to the rounding process |

Assignment B: Total hours (115) divided by total in cycle (152) = .757 x 8 hrs = 6.06 hrs (rounded to 6 hrs) |

| Assignment A pays 1.5 hrs (.75 x 2) and Assigment B pays 12.5 hrs (6.25 x 2) |

Assignment A pays 1.5 hrs (.75 x 2) and Assigment B pays 12 hrs (6 x 2) |