University of California Davis Self-Supporting Recharge Operations - Rate Proposals & Modifications

The information within this section should be used for both the development of new rates as well as modifications to existing rates.

Content

- Considerations of Rate Development

- Allowable and Unallowable Costs

- Rate Calculation Sheets

- Deficit/Surplus Recovery Plans

- Approval Timeline

- Approval Letters

- Published Schedule of Rates

Considerations of Rate Development

- Units must develop rates that recover the full direct costs of the recharge activity and, when appropriate, indirect costs.

- Direct Costs: Rates are based on estimates of direct costs. Rates include estimates of costs that will be incurred (e.g., salaries, benefits, supplies) and estimates of quantities that will be produced (e.g., tests performed, hours worked, products provided).

- Indirect Costs: Rates may also include indirect costs. Generally, the campus uses a standard mechanism to collect indirect costs. For example, the Facilities and Administrative (F&A) rate is used to recoup indirect costs from federal customers. The Non-University Differential (NUD) is used for non-university (also called outside or private) customers. In addition to the NUD, a unit may include a markup in a rate charged to non-university customers.

- Units must develop rates that achieve a breakeven financial performance. Similar to resolving operating surpluses and deficits, a three-year timeframe is reasonable for evaluating whether or not an activity breaks even.

- A unit must not charge internal customers in excess of the full cost recovery of the operation.

- Units must act in good faith on behalf of their customers and develop rates that are reasonable. Rates are considered reasonable if the nature of the costs included and the manner in which the goods or services are being provided reflect the actions that a prudent organization would have taken under similar circumstances.

- Units must apply their rates consistently to all university customers. Units cannot discriminate for or against any university customers. Units may develop rates that take into consideration things such as high volume or less demanding work; however, units must make these rates available to all customers who meet the specified criteria.

- Units may subsidize rates, but units must apply the subsidy against the full direct costs of the rate. The unit must apply the subsidy consistently to all university customers. The unit must be able to easily identify the full costs (including the subsidy) for the activity.

- Units that have rates related to housing animals (vivaria) must comply with the National Institutes of Health (NIH) Cost Analysis and Rate Setting Manual for Animal Research Facilities and all campus rate policies.

Allowable and Unallowable Costs

In general, units may recover all costs that are allowable per Title 2, Part 200 of the Code of Federal gulations (2 CFR 200). The allowable and unallowable costs listed below are some of the more common categories. NOTE: The list is not exhaustive.

Allowable costs

- The salaries, wages and benefits of the personnel directly related to providing the recharge activity are allowable. This includes personnel that maintain equipment used in the recharge activity or directly administer the recharge activity. However, incidental administrative costs are unallowable.

- Costs incurred for materials and supplies directly related to providing or administering the recharge activity are allowable.

- Costs incurred for necessary maintenance, repair and upkeep of equipment used in the recharge activity are allowable, provided that such costs do not appreciably increase the value or useful life of the equipment.

- The depreciation of equipment and capitalized improvements is allowable, unless the equipment or improvements were purchased with federal funds or were included in a Facilities and Administrative (F&A) cost pool. If you do not know if the equipment is included in an F&A cost pool, contact the Office of Costing Policy & Analysis, Finance.

- A prior-year operating deficit (increases a recharge rate) or a prior-year operating surplus (decreases a recharge rate) is allowable. In general, a unit must address a surplus or deficit within three years.

Unallowable costs

- Administrative costs not related to the recharge activity are unallowable. Also, incidental administrative costs related to the activity are unallowable. Incidental administrative effort is when an individual contributes less than 5% of his/her annual effort in support of an activity.

- In general, advertising and public relations costs are unallowable.

- Bad debts, fines and penalties are unallowable. Exceptional charges that did not occur through the normal course of business are also unallowable.

- Costs of entertainment (amusement, diversion and social activities) and any costs directly associated with entertainment (tickets to shows or sporting events, meals, lodging, transportation, etc.) are unallowable.

- Costs already paid by the federal government are unallowable. This includes depreciation for equipment purchased with federal funds or space constructed with federal funds.

- In general, acquisition costs associated with the purchase of equipment, land, or buildings are unallowable.

- Depreciation, capitalized renovations, or leasehold improvements are unallowable when the underlying asset is already included in an F&A cost pool.

- Costs associated with the operation and maintenance of space that is eligible for state operations, maintenance and plant (OMP) support, including building depreciation and utilities, are unallowable.

- A reserve for improvements (RFI) (also known as a contingency or expansion reserve) is an unallowable cost for federal customers. See Section I.C.2, Reserve for Improvement, below for details.

- Internal campus assessments and overhead costs, such as UCOP and UCPath assessments, insurance premiums recovery (GAEL), Common Goods Assessment (CGA) and any other general overhead like assessments are unallowable.

Required Rate Calculation Sheets

The worksheet below should be completed for both new and modified rates. Once completed, they should be submitted to the office of the dean, vice chancellor or vice provost (D/VC/VP) for approval. The D/VC/VP will forward the approved rate worksheet to the Recharge Team (email recharge@ucdavis.edu). Additional approvals may be required based upon guidance posted to the Authorization page.

- Rate Calculation Worksheet (XLSX) (Use if ≤10 Rates) V7.1 updated Apr 2024

- Rate Calculation Worksheet-100 Rate (XLSX) (Only use if ≥11 Rates) V7.1 updated Apr 2024

- Rate Calculation Worksheet Guide (PDF) updated Mar 2024

***The prior version of the Rate Calculation Worksheet will still be valid for submission up to June 30th, 2024***

Questions about the Rate Calculation Worksheet can also be emailed to the Recharge Team (recharge@ucdavis.edu).

Deficit/Surplus Recovery Plans

If you are modifying rates as part of the annual compliance reporting, and have incorporated a deficit or surplus recovery plan into your rates, please include Appendix C-2 from the Guidelines for Deficit Management and Monitoring in Campus Units document.

Approval Timeline

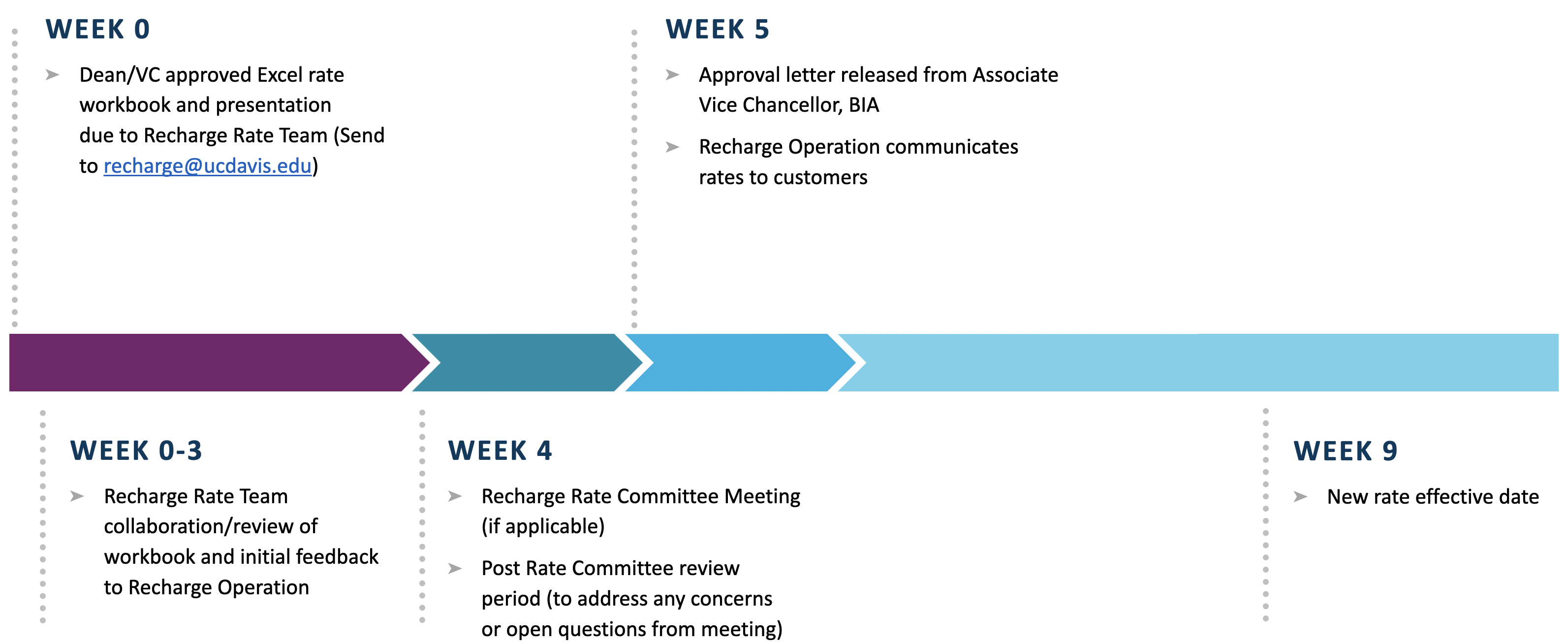

The graphic below illustrates the timeline from initial approval of the required documentation to the implementation of a new rate package.

Approval Letters

If approval by BIA is not required, then the office of the D/VC/VP is responsible for communicating the establishment of a new activity or the modification of an existing activity to recharge@ucdavis.edu. A signed PDF copy of the "Recharge Operation Form" tab in the Rate Calculation Worksheet now serves as the approval letter for rates where the D/VC/VP is the Office with Final Approval.

For rates requiring BIA or Costing Policy & Analysis approval, the signed "Recharge Operation Form" and the Excel workbook should be submitted to recharge@ucdavis.edu to initiate the remaining central campus approval steps. An approval letter will be issued from the Associate Vice Chancellor—Budget and Institutional Analysis once the rate package is deemed in compliance with all applicable costing policies and procedures.

The office of the D/VC/VP is the office of record for recharge activities and is responsible for maintaining documents related to the establishment, modification, and termination of a recharge activity. In addition, a copy of all documents related to the establishment, modification and termination of a recharge activity must be sent to recharge@ucdavis.edu regardless of approval level.

Published Schedule of Rates

Once a self-supporting recharge activity has been approved, units must publish a schedule of their approved rate(s) for customers and prospective customers to view. The schedule of rates must be published online or be readily available at the unit’s office.