- What is the Composite Benefit Rate Add-On (Prop 2)?

Under the 2015-16 state budget agreement with the Governor, the University of California received $436 million in one-time funds over three years in Proposition 2 debt repayment funds for the UC Retirement Plan (UCRP). Since the state funds are contributed directly to UCRP, all the university’s funding sources, rather than just the State General Fund, benefit from these additional retirement contributions. This essentially lowers the composite benefit rate on all funds. As such, UCOP is encouraging campuses to assess funding sources other than core funds of State appropriations and tuition, where allowable, to ensure that State General Funds and tuition fully benefit from the investment by the State. The assessed funds will be used to reduce the campuswide General Funds and tuition deficit.

The CBR Add-On is an automatic process to assess the appropriate funds to recover the savings in UCRP costs. The assessment is based off of monthly salary expenses and post to Object Code 8510 within Object Consolidation SUB6 - Employee Benefits.

Full details are available on the Budget & Institutional Analysis Composite Benefit Rate Add-On Overview.

- What are the allowable funding sources for campus units?

- Allowable sources include such sources as Auxiliary, Med Comp funds, Student Services Fee, Campus Based Fees, Professional Degree Supplemental Tuition, and Indirect Cost Recovery.

- What are excluded fund sources?

Excluded fund sources, based on guidance from UCOP, include state General Fund and tuition, Contracts & Grants, recharge activities that charge Contracts & Grants, and State Appropriations.

Accounts with the following attributes are excluded:

> Sub-Fund Group Type: 1, B, C, D, F, G, H, J, L, N, P, S, V, W, X

> Sub Fund Groups: SSEDAC, SSEDPI, and OSSSO

> UC Funds: 19942, 20094, 20095, 20321, 20323- What are the assessments based on?

The assessments are based on specific payroll Object Consolidations and Expense (EX) account types only.

> Object Consolidations: SB01, SB02, SB03, SB04, SB05, SB06, SB07, SUBS, SUBG, SUBXOnly accounts in Charts 3 and S are included.

The assessment rate is based on UC Office of the President estimates of the payroll assessment that would have otherwise been required if equivalent funds had instead been borrowed from STIP (cash reserves) and repaid over time. The rate is the same for all Chart 3 and Chart S accounts. Chart H will be assessed separately. A detailed breakdown is available on the Budget & Institutional Analysis Composite Benefit Rate Add-On Overview.

- What is the Assessment Rate?

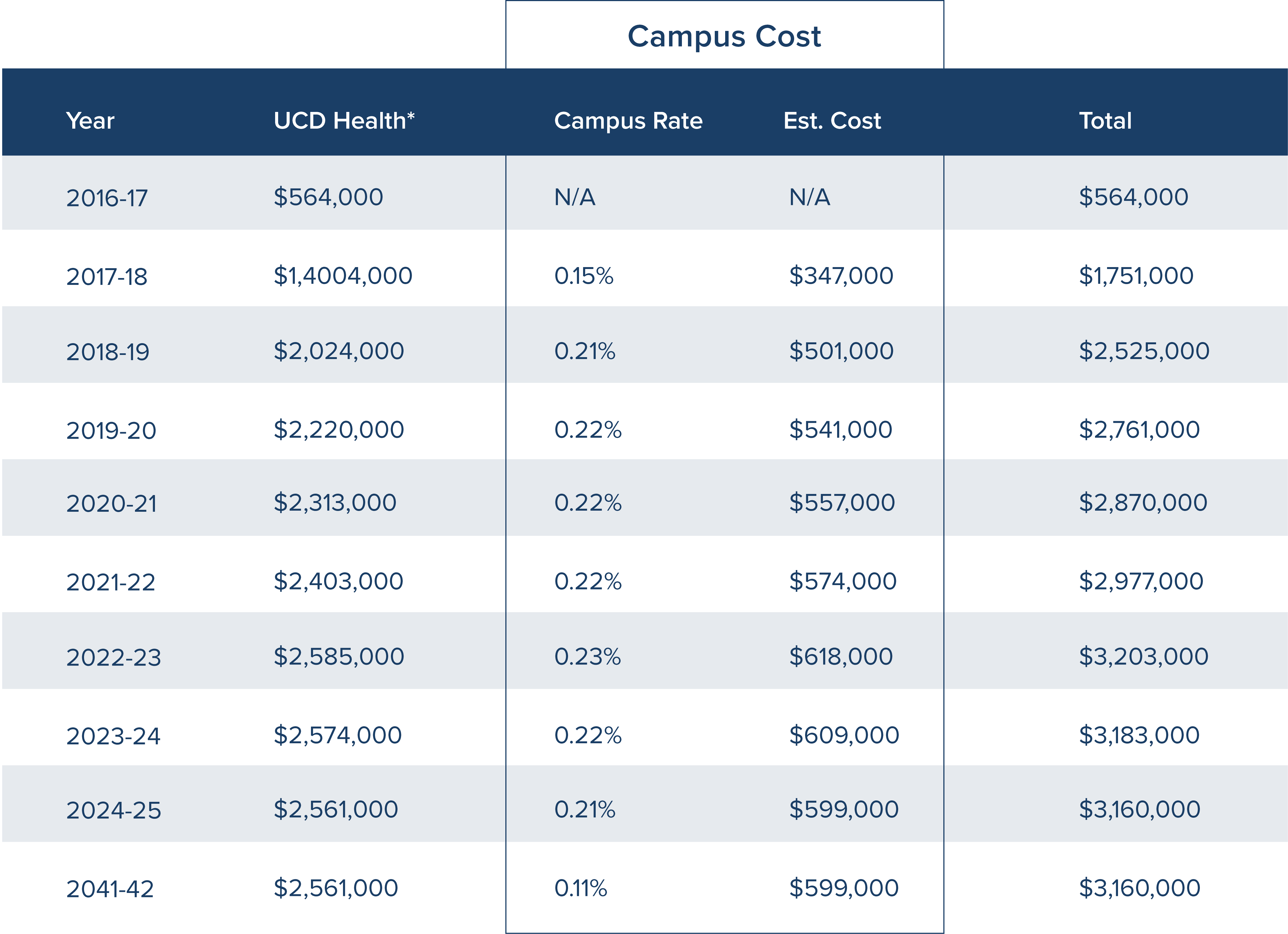

- As additional funds are transferred from the State to UCRP, the annual assessments will increase for several years and then level off until fully paid off by 2041-42, as follows: